INTRODUCTION

Natural gas is a fossil energy source that formed deep beneath the earth’s surface. It is a non-renewable hydrocarbon used as fuel for vehicles and to make materials and chemicals.

Natural gas is the fastest growing fossil fuel, accounting today for 23% of global primary energy demand and nearly a quarter of electricity generation. Being the cleanest burning fossil fuel, natural gas provides a number of environmental benefits compared to other fossil fuels, particularly in terms of air quality and greenhouse gas emissions. Its storability and the operational flexibility of gas-fired power plants allows natural gas to respond to both seasonal and short-term demand fluctuations and to enhance electricity supply security in power systems with a growing share of variable renewables. (1)

Natural gas is found in deep underground rock formations. In the United States and in a few other countries, natural gas is also produced from shale and other tight types of sedimentary rock formations by forcing water, chemicals, and other materials down a well under high pressure. This process, called hydraulic fracturing or fracking, and also referred to as unconventional production, breaks up the formation, releases the natural gas from the rock, and allows the natural gas to flow up through wells to the surface.

GAS CONSUMPTION IN THE DANUBE REGION

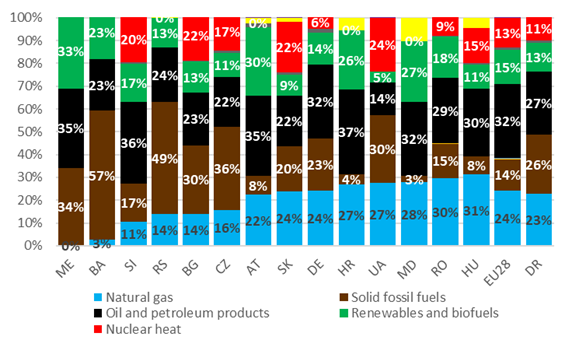

The share of gas in the total primary energy supply of the Danube Region is 23%, very similar to the average of the EU28, while the contribution of solid fossil fuels – especially coal and lignite – is much higher (26% compared to 14% in the EU28). The average import dependency in the gas sector is 73%, being close to 100% in half of the DR countries. On average, households use most of the natural gas (41%) followed by the electricity and heat sectors (26%) and industry (24%). The future role of natural gas in the Danube Region highly depends on the national decarbonisation plans for these sectors.

Fuel mix of the total primary energy supply in the Danube Region and in the EU28 (2018)

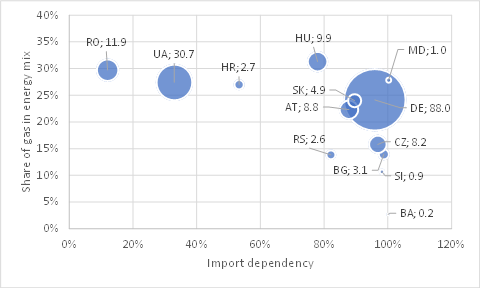

The Danube Region total gas consumption was ~170 bcm/yr in 2018, Germany alone accounted for almost ~90 bcm/yr followed by the second largest Ukraine with ~30 bcm/yr. The region is very heterogeneous as there are a few middle size countries with mature gas markets around ~10 bcm/yr (Romania, Hungary, Austria Czechia) and some around ~5 bcm (Slovakia, Bulgaria and Croatia) followed by small countries with around or less than 2 bcm/yr markets (Bosnia & Herzegovina, North Macedonia, Moldova, Serbia, Slovenia) and Montenegro does not yet have gas in the fuel mix at all.

The Danube Region imports 77% of its gas consumption. The import is above 80% in 10 out of the 14 countries, and close to 100% in Bosnia and Herzegovina, Bulgaria, Czechia, Moldova, Slovenia, and Slovakia. Based on the national forecasts, the gas import dependency will stagnate or slightly increase. The only exceptions are Ukraine, Hungary and Romania, these are the countries that foresee increased domestic gas production by 2030.

Share of gas in the energy mix and gas import dependence by country, 2018

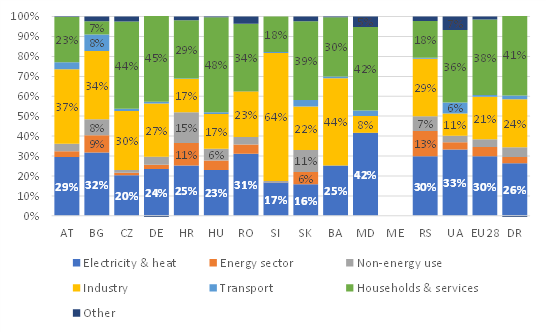

On a regional average, the sectoral distribution of gas consumption in the DR is slightly lower than the EU in power generation (26% compared to 30%) and slightly higher than the EU in the share of household and services (41% versus EU28:38%) and industrial consumption (24% compared to 21%). At the country level there is a wide variance within this average.

Structure of gas consumption by sectors in the Danube Region (2018)

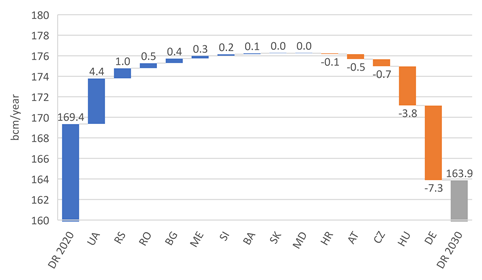

Based on the country documents available, the total gas consumption of the Danube Region is planned to drop by 3% by 2030 (~6 bcm/yr). Volume growth is expected in Ukraine, Serbia, Romania, Bulgaria, Montenegro, Bosnia & Herzegovina and Slovenia. On the other hand, about twice as much gas volumes are planned to be saved in mature markets of Germany, Hungary, Czechia and Austria. This marginal change in volumes does not call for huge pipeline investments, there is only one plan that cannot be served by the current gas network in place: the gasification of Montenegro. Montenegro on the other hand does not plan to use sufficient gas volumes in the long term to justify investment into gas transmission networks even on other countries territory (Albania and Croatia) as well.

Change in the gas consumption in the Danube Region 2018-2030 (bcm/yr)

GAS INDUSTRY IN THE DANUBE REGION

The Danube region suffers from specific gas industry problems. The most serious of them is the lack of sufficient interconnectivity which impedes gas supply source diversification for the region, reduces the scope for gas market integration and supply security improvements at the regional level. The European Infrastructure Package (EIP) intends to identify and provide Union level support for gas infrastructure projects that will positively impact interconnectivity and market integration in the region. The EIP identifies certain priority corridors, which in the case of gas includes linking the Baltic, Black, Adriatic and Aegean Seas. The development of north-south interconnections in Central and Eastern Europe and Southeast Europe forms an important element of this corridor.

INFRASTRUCTURE, GAS STORAGE AND LNG PLANS

As there is no major change in gas consumption anticipated by country strategies, nor a significant drop of domestic production, the number of gas projects listed in the Danube Region as ‘planned to be implemented by 2030’ is alarmingly long.

Diversification of imported natural gas sources has been high on the agenda in this region for long (since the 2009 crisis) with the aim to increase the resilience of the system to supply shocks and also to develop competition on the wholesale level by providing access to the market for increasing number of suppliers.

Many projects and national strategies are related to the Russian diversification projects. The Danube Region is impacted by the Russian large (offshore) transmission infrastructure investments: Nord Stream 1-2 entering the EU in Germany (NS 2 94% ready) and Turk Stream 1-2 already reaching Turkey. The route of the Russian gas has already partly changed (since 2020 no flows on Transbalkan e.g., UA-MD-RO-BG-TR) and will further change when Nord Stream 2 and Balkan Stream will be commissioned. From the North the onshore projects that connect these Russian investments are already part of the national TYNDP in Germany, and related investments in Czechia and Slovakia are partly implemented or highly advanced. From the South the Balkan Stream entering in Bulgaria and stretching via Bulgaria and Serbia till Hungary is also under construction, plans to enable flows from the South in Hungary and up to Slovakia are also part of the plans.

New LNG terminals in the region are top priorities for every DR country: an LNG terminal in Croatia is under construction with a regional focus and two terminals are planned in Germany.

There are huge gas storage capacities in the region already, still development is foreseen in some countries, usually related to capacity extensions of existing facilities.

IMPACTS OF DECARBONISATION ON NATURAL GAS

As the EU moves towards its 2050 targets, a mix of low and zero-carbon gaseous fuels, such as biogas, biomethane, blue and green hydrogen, and synthetic methane are expected to replace natural gas. Biogas and biomethane are currently the most commercially ready alternatives to natural gas and require no major infrastructural upgrades. However, their production will be limited by the availability of feedstock and regional contexts. Hydrogen can also be produced to replace the use of natural gas. There is a clear regional split between countries in terms of future plans with the existing natural gas transmission network: the EU countries usually mention the plan to test/develop their system to be able to transport some hydrogen (blending hydrogen). This goal is not yet set in the non-EU countries. Non-EU countries, but also some EU countries on the Balkans prioritize DSO system development with the aim to gasify and make gas available for heating purposed for district heating and for households.

The decarbonisation agenda impacts the role of natural gas in electricity and heat generation in two ways:

- in the short run the phase out of coal fired units provides a temporary window of opportunity for increased gas consumption

- in the long run the full phase out of natural gas as a fossil fuel will reduce the lifetime of CCGTs and gas fired CHPs

According to NECPs, the decarbonisation agenda does not have a tremendous impact on the gas consumption in the electricity and heat sectors up until 2030 in the Danube Region. In general, household gas heating will remain substantial in the long term (beyond 2030) despite broad support for RES installations. According to national strategic documents, measures supporting decarbonized household heating as an alternative to gas are technically available but not financially preferable. On the other hand, building renovations should reduce significant volumes of natural gas consumption.

POLICY BACKGROUND

“Clean Energy for All Europeans” package (2016)

European Climate Law COM(2020) 80 final

LIBRARY

https://www.iea.org/fuels-and-technologies/gas

USEFUL LINKS

Energy Community – https://www.energy-community.org/

Central and South Eastern Europe energy connectivity – https://ec.europa.eu/energy/topics/infrastructure/high-level-groups/central-and-south-eastern-europe-energy-connectivity_hu

International Energy Agency – https://www.iea.org/fuels-and-technologies/gas

European Commission (Energy) – https://ec.europa.eu/energy/home_en

EUROSTAT (data) – https://ec.europa.eu/eurostat/web/energy/overview

European Energy Network – https://enr-network.org/

World Energy portal – https://www.world-energy.org/

Gas Infrastructure Europe – https://www.gie.eu/